Welcome to The Index Investor

Global Macro Analysis and Asset Allocation Insights

We also publish a free weekly Substack newsletter: New Global Macro Evidence and Forecasts.

You can subscribe here.

Researchers have found that when uncertainty rises, evolution has led human beings to become much more prone to conformity and to rely more on imitating what others are doing (so-called "social learning").

Paradoxically then, as uncertainty increases, people — including many sophisticated investors — are more likely to become attracted to a smaller (not larger) number of competing narratives about the future. In other words, as uncertainty increases the conventional wisdom grows stronger, even as it is becoming more fragile and downside risks are rising.

Today's hyperconnected socio-technical systems — including financial markets — are therefore more vulnerable than ever before to small changes in information which trigger feelings (especially fear) and behavior that spread quickly, and are further amplified by algorithms of various types. The result is an increasing probability of sudden, non-linear changes in asset class valuations and returns.

Despite this, warnings to investors about downside risks are still all-too-rare. As the legendary investor Jeremy Grantham has observed, this is frustrating but not surprising:

"The combination of timing uncertainty and rapidly accelerating regret on the part of clients means that the career and business risk of fighting bubbles is too great for large commercial enterprises… Their best policy is clear and simple: always be extremely bullish. It is good for business and intellectually undemanding. It is appealing to most investors who much prefer optimism to realistic appraisal, as witnessed so vividly with COVID. And when it all ends, you will as a persistent bull have overwhelming company. This is why you have always had bullish advice in bubbles and always will."

Since 1997, our purpose has been to provide timely and actionable strategic risk intelligence to investors, corporate, and government leaders that enables them to better anticipate, more accurately assess, and adapt in time to emerging macro threats.

Accurate foresight is the key to superior investment results, including avoid large losses that can ruin an investment plan. A simple way to increase predictive accuracy is to combine forecasts from different sources that are based on different methods and/or information. This is one of the reasons investors subscribe to our research publications.

For 24 years, we've made sense of global macro uncertainties, and provided subscribers with advance warning of the 2000, 2008, and 2020 financial crises, to help them avoid the portfolio losses they triggered.

What Our Subscribers Say:

"I am delighted to get your analysis. We get everything from Wall Street, and they all seem to be saying the same thing. Your take is greatly appreciated."

"Your research is unique. There's nothing else like this out there."

"Really enjoy reading your work. It is one of the most independent views I see."

"Your team’s economic, investment and geo-political analysis is always in-depth and thought provoking and the forecasts are persuasive."

Here's a brief description of our forecasting process:

We provide insights about the evolving dynamics of the global macro system, and early warning of emerging threats that lie beyond the detection horizon and analytical capabilities of quantitative algorithmic methods. We translate our insights into probability forecasts for different macro regimes, and use them to adjust our model portfolio's asset allocation.

Accurate foresight comes not just from good forecasting skills, but also from asking the right questions. Arguably, the second is more difficult.

Compared to new quantitative data, new qualitative data diffuses more slowly across market participants, and is only gradually incorporated into asset prices.

This time delay, plus the accuracy of their mental models and forecasts, enables astute investors to avoid large losses and achieve higher returns by taking action before the market's dominant narrative changes.

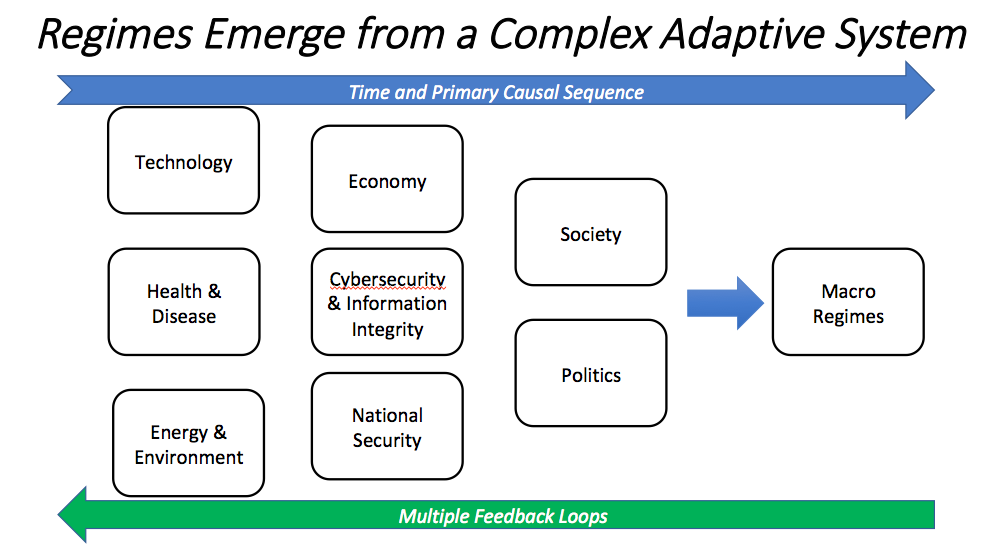

To help investors achieve these goals, we use a method called Multipath Analysis. We collect and combine high value information (threat indicators and surprises) in the areas of technology, health and disease, energy and the environment, the economy, national security, society, politics, and financial markets.

The complex interactions of trends and uncertainties in these areas cause the effects we later observe in the form of market narratives and investor beliefs, from which emerge financial market valuations and returns.

This approach enables us to ask the right questions, accurately forecast their answers, and synthesize their implications for subscribers.

Rather than statistical or machine learning, our approach to forecasting more closely resembles estimative intelligence analysis, which employs a combination of bottom-up and top-down sensemaking processes.

More information about our forecasting methodology can be found here. The history of Index Investor since its founding in 1997 can be found here. Our core beliefs about the nature of financial markets, asset allocation, and active versus passive investing can be found here, including 15 year results for our model index portfolios and their asset allocations.

Each week we publish significant new macro evidence and its impact on our forecast on Substack. You can sign up for these free emails at newmacroevidence.substack.com.

Here's what you'll get in each quarterly issue of The Index Investor — all for just $250/year or $24.95/month.

(1) Narrative forecasts and quantitative 12 and 36 month probability estimates for four possible macro regimes: Normal Times, High Uncertainty, High Inflation, and Persistent Deflation.

(2) Estimated asset class over/under valuations and updated market stress indicators (e.g., levels of uncertainty, herding, liquidity, and credit risk.

(3) Tactical Asset Allocation implications of our analyses.

(4) A cumulative, chronological "Evidence File", that contains two kinds of high value information that we have used to update our monthly forecasts. The first are "indicators" that cause us to either increase or decrease our uncertainty about the values of different parameters in our mental model of the complex macro system. The second are "surprises" that increase our uncertainty about the structure of that model.

Evidence is categorized by month and divided into separate sections covering the areas that drive global macro dynamics, including technology, energy and the environment, the economy, national security, society, politics, financial markets and investor behavior, as well as two potential "wildcards": health and infectious disease, and cyber and electromagnetic events.

From an AI perspective, each month we provide a tagged data set that can be combined with similar inputs from other sources, and subsequently analyzed using Natural Language Processing methods.

(5) In between monthly publications, we publish flash updates — on our Substack, on our blog, on our LinkedIn page, via email, and via our Twitter @indexllc — if and when we obtain high value information that results in a substantial change to a forecast probability.

For example, based on our previous research and writing on pandemic threats, we started warning about the danger posed by COVID-19 on January 27th — well ahead of the S&P 500's peak on February 19th.

(6) A feature article providing an in-depth analysis of either a key macro-uncertainty (e.g., how close the system is to one or more critical thresholds buy fake id) or an aspect of making good investment decisions in the face of complexity and uncertainty. These articles typically synthesize a broad range of academic research and practitioner experience to provide thought provoking insights about critical issues facing investors and their advisors. Here's a list of the feature articles we're recently published.

You can download a free sample copy of a recent issue to get a better appreciate the value we provide subscribers each month.

Our back issues and Research Library are both free. Investors can browse our curated content on a critical uncertainties that could have a substantial impact on medium and long-term asset class valuations, including technological, environmental, economic, national security, social, demographic, political, and financial market trends and uncertainties, as well as potential "grey swan" wildcards like infectious disease, cyber, and large-scale electromagnetic events.

We also provide custom research as well as speaker services on how to increase forecast accuracy, understanding the differences between active, passive, and index investing, and how to overcome the individual, group, and organizational obstacles to making good decisions in the face of uncertainty. Our speaker offerings include seminars for advisors' clients and speeches for larger groups. Click here to learn more.

Index Investor LLC also publishes The Retired Investor, which focuses on issues related to the decumulation stage of financial life. It offers most of The Index Investor's content, but not the Evidence Files.

We are affiliated with Britten Coyne Partners, which provides strategic risk consulting services to management teams and boards, and the Strategic Risk Institute LLC, which provides online and in-person education offerings leading to a Certificate in Strategic Risk Governance and Management.

Follow The Index Investor on Twitter